Improving Brand Equity and Lead Quality through Portfolio Monitoring

- 02/26/2021

- Administrator

- 0

Understanding the ever changing customer needs by continuously monitoring and analyzing their home and mortgage events

As everyone knows home ownership is one of the major life cycle stages for most of us and home loans constitute the largest part of our total household debt. So, understanding someone’s home ownership status and their mortgage information, can provide a lens into how we could help them improve their net financial status – increase monthly net cash in hand or increase equity in their investments.

Events pertaining to someone’s home or their mortgage is a leading indicator of their financial status and the impending financial activities they are about to embark on. And such indicators can help a financial institution get ahead and engage the customer to improve their financial position and to expand your relationship.

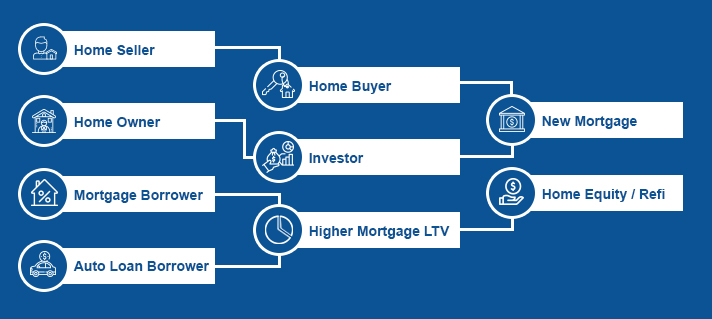

Let us take a look at four examples of how understanding a customer’s current financial position as reflected by their home ownership and mortgage status can help us cater services to them.

Home sellers are usually home buyers

In 2019, 67% of the home buyers were repeat buyers. In other words they were either buying a second home or sold their current home and bought a different home. And about 9% of buyers wanted a larger home.

So, when a home comes on the market for sale there is a pretty good chance that the seller is going to buy another home pretty soon and they have already made up their mind on where they are moving next.

So being alerted when a home goes on the market can be valuable for a loan officer to identify a new opportunity or a repeat customer if they are currently in the portfolio.

Homeowners decide to use their home equity for a loan

Many homeowners take a second mortgage on their property for home improvement or other financial needs due to the tax benefits on the interest paid. According to the 2020 Home Equity Lending Study by the Mortgage Bankers Association, the average loan-to-value (LTV) on a HELOC was 24% and the average LTV on a home equity loan was 30%.

In other words, most homeowners if they are interested in a home equity loan would go for it if their LTV is approaching 30%. So, the LTV on a mortgage is an indicator of the potential for the homeowner to apply for a home equity loan product.

Auto loan customers need a mortgage refinance

A lender’s auto loan portfolio provides valuable information to cross sell other home loan products. Here’s how it works:

- Start with the mailing address for each auto loan borrower.

- If the owner of property at the mailing address matches the borrower’s name, we can derive that the auto loan borrower is also a homeowner for that address.

- Once we identify the homeowner, monitoring for activity on the property and the mortgage will start providing us leading indicators for cross selling mortgage products.

For example, if that customer’s LTV is below 80% and their mortgage rate is at least half a point above the current rate for the zipcode, it is a refinance opportunity.

A homeowner wants to get into real estate investing

Since 2006, more than 25% of investors in the stock market have added real estate to their portfolio. And a huge portion of such real investors are landlords who want to generate additional income as opposed to full time real estate investors who are buying, renovating, and flipping properties.

Using the property and mortgage data we can find homeowners who own more than one home and their current mortgage and LTV positions. In addition, we can also keep an eye out for new investors in the market as they go from occupying their homes to start renting their homes.

Once identified we could help such investors or potential investors with products that can help them build wealth and recommend investments that meet their goals.

The benefits of understanding your customer

Looking into your existing customer list for homeowners and understanding their current investment in their home will help you deliver additional value to those customers and improve their satisfaction. In addition, here are a couple of more facts

- We all know that the cost of acquiring new customers is many time higher than expanding your wallet share with an existing customer

- This creates an opportunity for the lender to pass on such savings to the customer and improve the value delivered.

- Customers’ brand loyalty is mostly in response to the trust they establish in the company via the value they receive.

As you can see the long-term value of understanding the client’s needs and responding to that with appropriate value helps build longer lasting customer relationships.

So, how can you execute on all this?

The easy way: contact us.

PropMix does all this for you with our service called Portfolio Monitoring. It is an innovative and comprehensive platform covering all the 151+million properties and every household in the US. We compute hundreds of predictors using thousands of data points on every property and mortgage. Our AI and machine learning engines are trusted by lenders and credit bureaus for decision making.

The hard way: DIY

As you can see to achieve such customer focus, you need data – especially data that is accurate – covering properties and mortgages. In addition, certain machine learning techniques can help us predict customers’ needs based on long running patterns within the data.

Here is a snapshot of our data and engines to help you with what type of cost and time commitments are required:

- 151+ Million properties data covering all 3100+ counties

- 60+ Million active mortgage records

- Decades of historical mortgage and deed history data

- Machine learning algorithms have been trained over the last 3 years on real world data

- Algorithms have been back-tested for accuracy of predictions

- 25+ Terabyte data storage mirrored across multiple regions for high availability

While most of the above – except our proprietary machine learning algorithms – can be implemented by anyone, the cost and time to do this can cause you to lose the window of opportunity.

Please contact us today to get started

References

2020 Home Buyers and Sellers Generational Trends Report, National Association of Realtors (NAR)

https://www.nar.realtor/sites/default/files/documents/2020-generational-trends-report-03-05-2020.pdf

Home Equity Lending Study, Mortgage Bankers Association (MBA)

https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/home-equity-lending-study